Iso tax calculator

More details on how this works below. The Stock Option Plan specifies the total number of shares in the option pool.

Secfi Can You Avoid Amt On Iso Stock Options

Whether you want to calculate your AMT or minimize your taxes with ISO exercise planning we can help.

. Your employer grants you an option to purchase stock in the employers. This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. Non-qualified Stock Option Inputs.

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that. Free Income Tax Calculator - Estimate Your Taxes - SmartAsset Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. In a nutshell your AMT is your regular income minus some personal deductions such.

How this calculator works. Please enter your option information below to see your potential savings. The stock options were granted pursuant to an official employer Stock Option Plan.

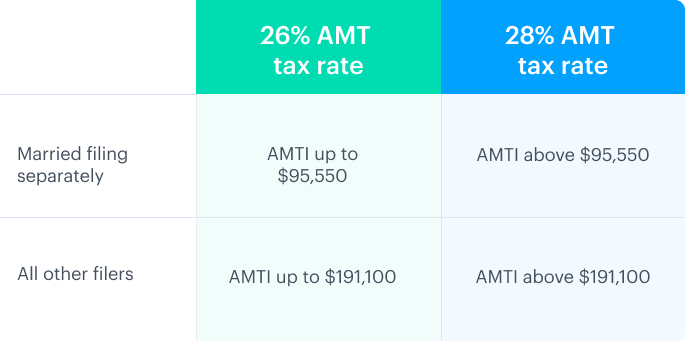

Thats a lower tax rate increasing your net gain by up to 27 percent. The Stock Option Plan specifies the total number of shares in the option pool. For 2020 the threshold where the 26 percent AMT tax.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Build Your Future With a Firm that has 85 Years of Investment Experience. The Stock Option Plan.

This is the actual price paid per share times the number of shares 20 x 100 2000 plus any amounts reported as compensation income on your 2021 tax return 2500. Once you reach a certain income level you have to calculate your AMT along with your federal income tax returns. The Stock Option Plan.

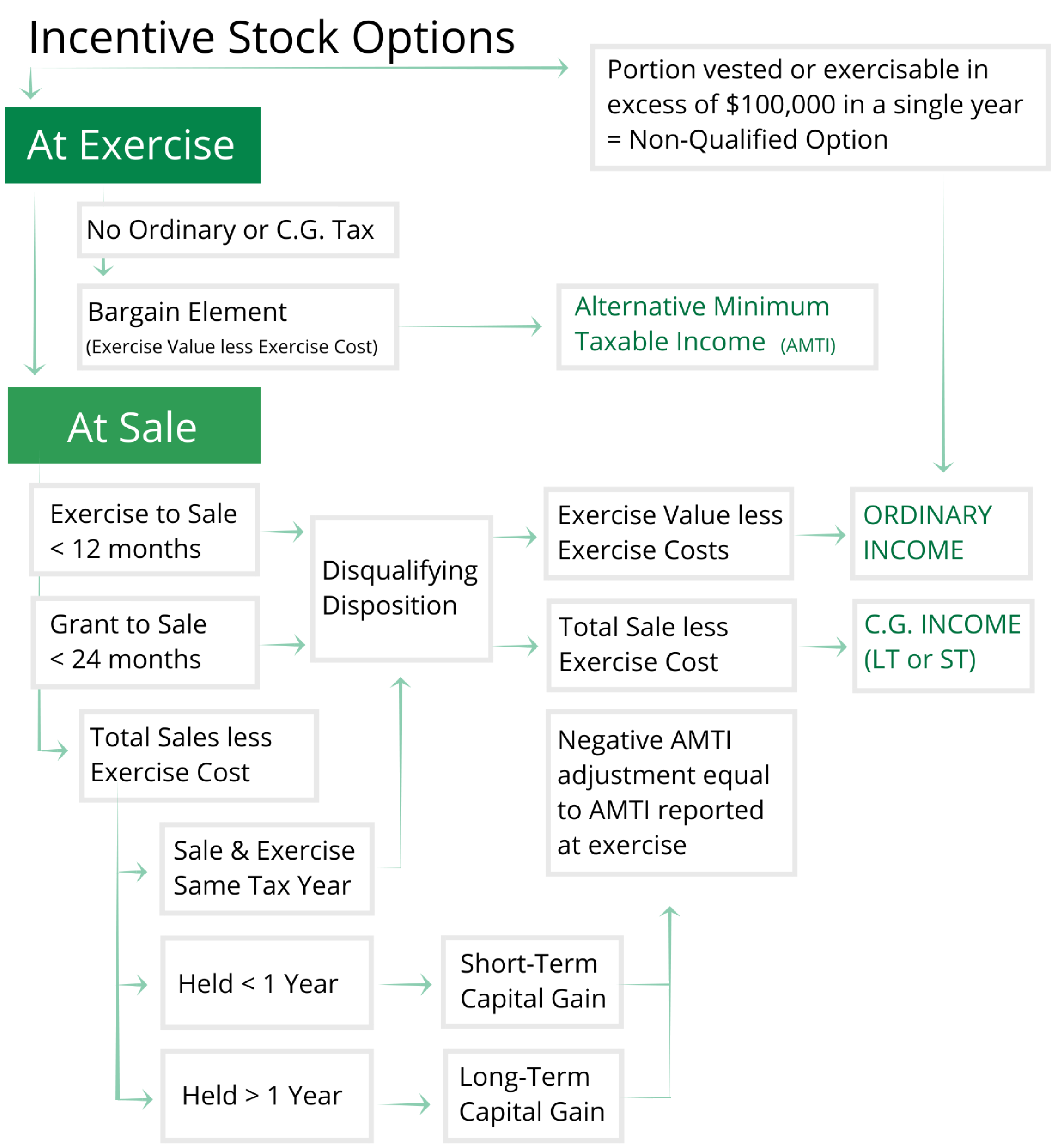

How AMT is CalculatedAMT is based on your alternative minimum taxable income. We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base. Begins with Total Income Subtracts the 2021 Standard Deduction Calculates Regular Income Tax based on the value from 2 and your statefiling status.

Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. If you have any further confusion regarding the calculation of taxes related to your incentive stock options be sure to discuss any questions that you have with your employer as soon as. Plan for your taxes.

The income level is the. This easy to use online alternative minimum tax AMT calculator estimates your tax liability after exercising Incentive Stock. We calculate the tentative minimum tax by applying the AMT rate either 26 or 28 depending on the amount to the AMT base.

The stock options were granted pursuant to an official employer Stock Option Plan. Calculate my AMT Reduce my AMT - ISO Planner. For 2018 the threshold where the 26 percent AMT tax.

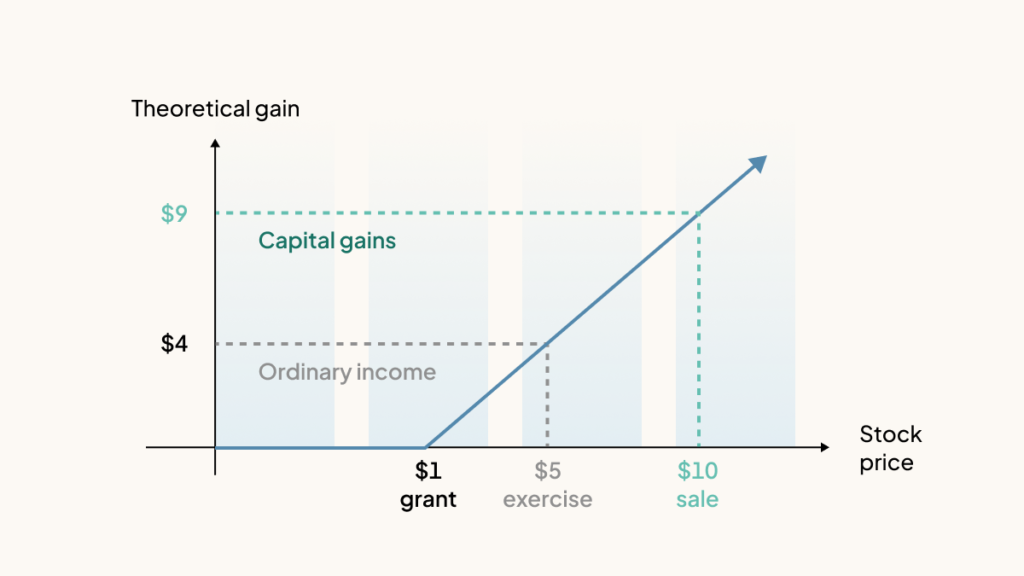

Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. Whatever you paid at 1 will be subtracted from your liability at 2. Tax Consequences of Selling ISOs.

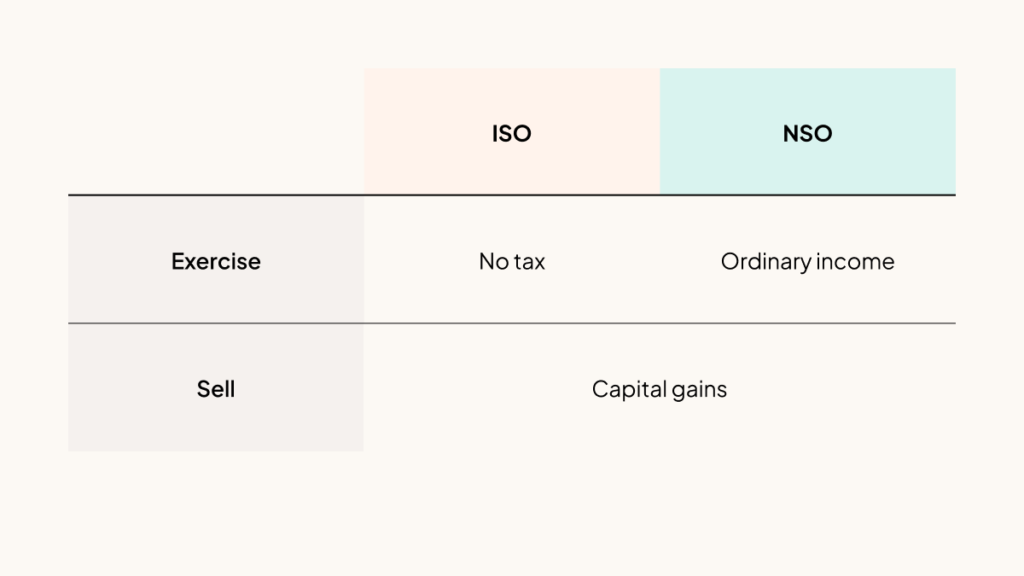

Incentive stock options ISOs are a type of employee compensation in the form of stock rather than cash.

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Net Profit Margin Calculator Bdc Ca

What Is The Alternative Minimum Tax Amt Carta

Blog Upstart Wealth

Tax Planning For Stock Options

Blog Upstart Wealth

Equity 101 How Stock Options Are Taxed Carta

Oh757g6xsysfim

What Are The Holding Period Requirements Of An Iso Mystockoptions Com

Should I Take An Nso Extension

.png)

Nabo Portatil Ortodoxo Irs Amt Calculator Carrera Pureza Unidad

Isos Tax Return Tips And Traps Mystockoptions Com

Stock Options For Startups Founders Board Members Isos Vs Nsos

8 Tips If You Re Being Compensated With Incentive Stock Options Isos

Isos Tax Return Tips And Traps Mystockoptions Com

How Stock Options Are Taxed Carta

Stock Options For Startups Founders Board Members Isos Vs Nsos